Tax Incentives Available to CT Farmers

Did you know:

As a Connecticut farmer, you may be eligible for grants and tax incentives that can assist you with your finances?

This may mean lower tax payments, tax refunds, or cash payments in the form of grants.

CT State Taxes

When you buy farm machinery, equipment, tools, building materials, you may be eligible for a refundable 20% property tax credit if you:

-

Purchase technology, equipment, building infrastructure, and other tools placed in service after January 1, 2026 (unclear based on current legislation whether placed in service in 2025 qualifies) for agricultural production

-

Use the asset for at least 5 years in CT, and

-

At least 2/3 of your gross income is from farming.

If your tax bill is less than the 20% credit, you may be eligible for a cash refund. (Public Act 25-152)

You may also be eligible for a Farmer Tax Exemption Permit that allows you to buy farm equipment, fuel, and other suppliers without having to pay sales and use tax (currently 6.35%).

Further, up to $100,000 of your farm equipment and machinery could be exempt from property taxes (which could range from 1.5% to 3.5% of your property’s assessed value). The $100,000 limitation increases to $250,000 starting 10/1/25. To qualify, you must make at least $15,000 of gross sales or prove at least $15,000 in farm related expenses.

Your land may also qualify to be assessed at its “use value” which is generally lower than fair market or best value, which could mean a lower property tax bill.

Federal Taxes

You may also qualify for federal tax benefits to reduce your federal tax bill:

-

Tax credits for fuel used in farming

-

30% credit for clean energy and qualified storage projects

-

For other federal tax benefits, please consult 2024 Publication 225

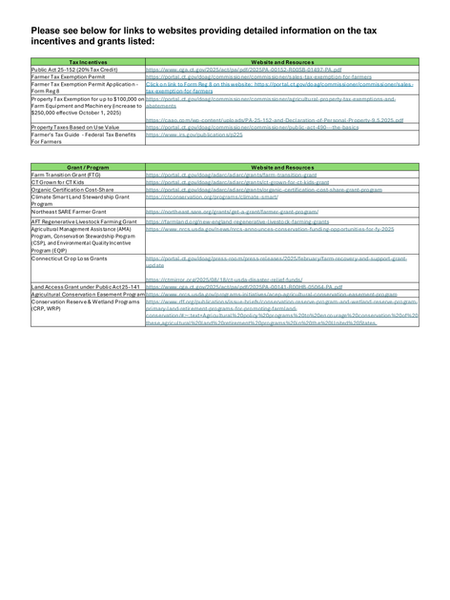

This compilation of incentives and grants is not exhaustive. Legislation and funding availability change daily. Click on hyperlinks to access websites. Please review the websites and contact the resources listed for the latest available information.